PolicyStreet has teamed up with Direct Lending, a digital lending marketplace platform, to introduce DirectCare+, a groundbreaking embedded personal accident microtakaful featuring loan protection. This innovative product marks PolicyStreet’s entry into the microtakaful sector, establishing it as a pioneer among home-grown insurtech ventures. DirectCare+ is designed to complement Direct Lending’s existing Auto Service Financing Plan, a digital Shariah-compliant installment plan for car services or repairs.

As Malaysians gear up for the festive season and prepare for the journey back to their hometowns during Hari Raya Aidilfitri, ensuring both vehicle maintenance and financial readiness is paramount. However, the financial strain of unexpected car repairs can be overwhelming for many Malaysians. Moreover, with road accidents on the rise, prioritizing financial security becomes even more critical, especially during festive periods when travel volume surges.

As Malaysians gear up for the festive season and prepare for the journey back to their hometowns during Hari Raya Aidilfitri, ensuring both vehicle maintenance and financial readiness is paramount. However, the financial strain of unexpected car repairs can be overwhelming for many Malaysians. Moreover, with road accidents on the rise, prioritizing financial security becomes even more critical, especially during festive periods when travel volume surges.

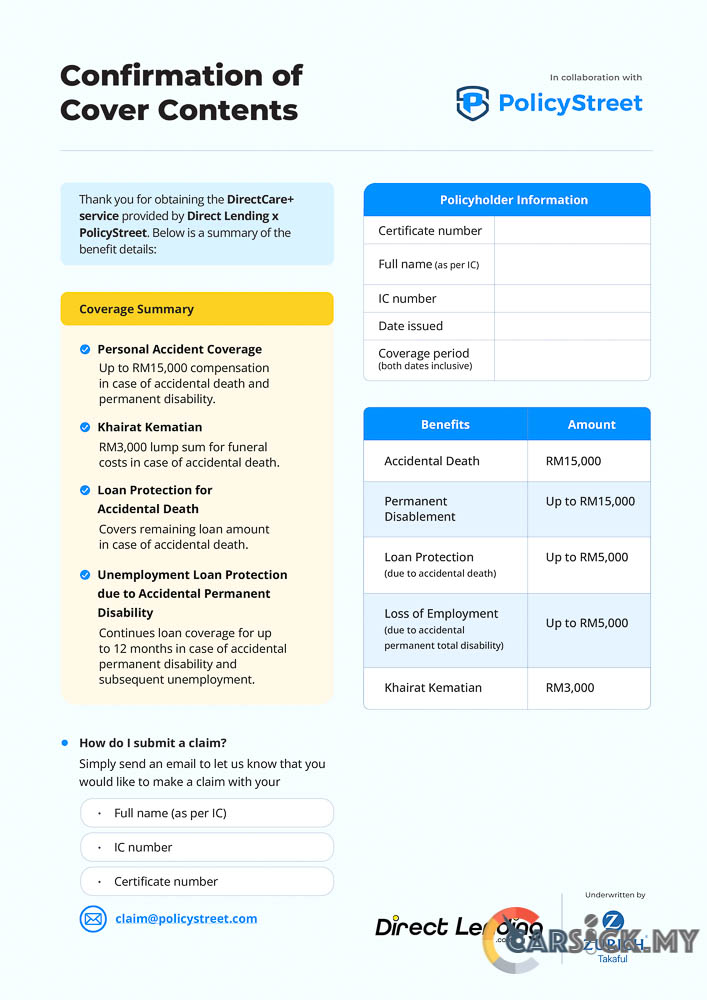

DirectCare+ addresses these concerns by providing an additional layer of financial protection against accidents resulting in death or permanent disability. This complimentary microtakaful is available to eligible users and applicants of Direct Lending’s Shariah-compliant Auto Service Financing Plan, which offers flexible payment terms of up to 12 months.

Direct Lending’s digital lending platform enables customers to conveniently apply for an Auto Service Financing Plan online or by scanning a QR code at any of the over 1,400 participating workshops across Malaysia. Through this collaboration, PolicyStreet and Direct Lending cater to the unique demand for Shariah-compliant financial services, offering peace of mind and financial support during heightened travel periods and potential risks.

DirectCare+ provides comprehensive financial protection in the event of accidental death, offering RM15,000 in coverage along with loan protection to settle any outstanding financing amounts. Additionally, it includes a lump sum of RM3,000 for funeral expenses. In cases of accidental permanent disability leading to unemployment, the loan amount will continue to be covered for up to 12 consecutive months. Applicants may also receive financial assistance of up to RM15,000, depending on the severity of the disability.

Users of the Auto Service Financing Plan eligible for DirectCare+ can extend their protection period for up to 12 months by opting in and paying a discounted rate as low as RM10 during the campaign period. This can be arranged before completing the necessary online “Checkout” process for utilizing the payment plan for their car service or repair bill at participating workshops.

This collaboration between PolicyStreet and Direct Lending underscores their shared commitment to making a positive impact on the lives of Malaysians by enhancing accessibility to financial services. It embodies the spirit of compassion and community that characterizes the festive season, aiming to provide practical solutions to financial challenges faced by individuals during festive travel.

For more details about DirectCare+ Personal Accident Coverage and the Auto Service Financing Plan, please visit www.directlending.com.my/auto-service-financing/.